Day 134: VD and Millionaires

So my kids are totally fried. I made them a study guide for the test next week that I described as "That thing you pull out of your pocket in the two minutes before a test in hopes that you might absorb a bit more knowledge before you get there." I told them they should look at it three or four times before they test next week, then they should have a bonfire and burn them. They kind of wanted to burn it right away; I can't blame them, but I at least want to know that I gave them everything they needed; whether or not they used it is up to them.

After we had this discussion and went over next week's testing schedule, I shared this article with them. It was the headline on Drudge Report last night when I had two boys in for tutorials, and had a good conversation about it. In class we briefly discussed the implications - that if the article says the US has 110 million cases of STDs, and the US population is 313 million people, this would mean that more than 1 in 3 people has an STD. The kids were horrified. And shocked I decided to share it in English class. I often go for the shock value in class; I feel like if they never know what to expect from me, they will pay more attention lest they miss something interesting or inadvertently hysterical. The discussion we had reminded me of a poster I had seen at the National Infantry Museum at Fort Benning, GA, that I found entertaining:

Following this little class convo, we headed to the library so kids could check out a book to read post-test next week, since they're not allowed to leave the testing room. I caught a few of my boys checking out pick-up trucks on Craigslist. I guess there are worse things for them to be doing. One of them said that some day he wants to buy a $70,000 truck. I asked him if he wanted to blow that much moolah on a truck. He said yes. I asked him if he knew what else he could do with $70,000. He said nope. So I got on my soapbox.

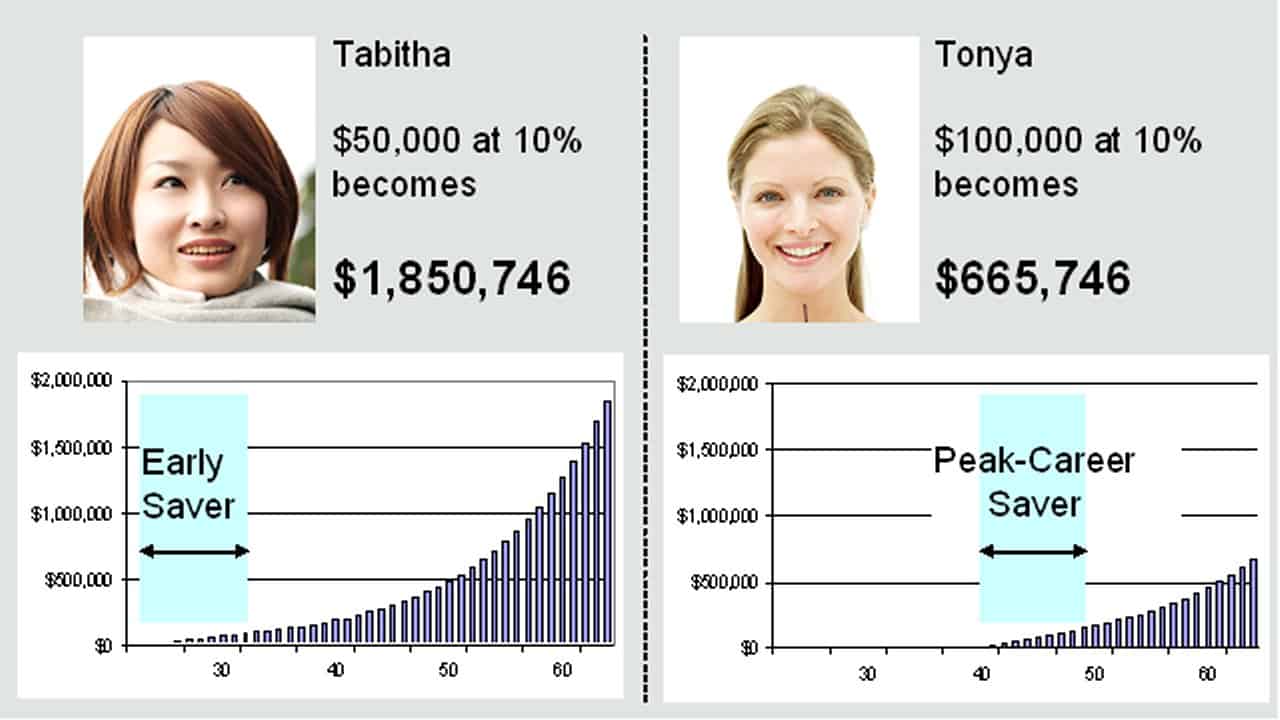

Those that know me well know that I am a huge Dave Ramsey fan; I listen to podcasts of his radio show on my commute, and my husband and are attempting to follow the general Financial Peace principles for our finances. I love sharing with other people how easy and freeing budgeting can be. I think I first got interested in family finances when I was in my senior year economics class in high school. My teacher showed us the classic bar graph to explain the importance of compound interest when saving for retirement, similar to this one from financiallife.org:

After we had this discussion and went over next week's testing schedule, I shared this article with them. It was the headline on Drudge Report last night when I had two boys in for tutorials, and had a good conversation about it. In class we briefly discussed the implications - that if the article says the US has 110 million cases of STDs, and the US population is 313 million people, this would mean that more than 1 in 3 people has an STD. The kids were horrified. And shocked I decided to share it in English class. I often go for the shock value in class; I feel like if they never know what to expect from me, they will pay more attention lest they miss something interesting or inadvertently hysterical. The discussion we had reminded me of a poster I had seen at the National Infantry Museum at Fort Benning, GA, that I found entertaining:

|

| Source |

Following this little class convo, we headed to the library so kids could check out a book to read post-test next week, since they're not allowed to leave the testing room. I caught a few of my boys checking out pick-up trucks on Craigslist. I guess there are worse things for them to be doing. One of them said that some day he wants to buy a $70,000 truck. I asked him if he wanted to blow that much moolah on a truck. He said yes. I asked him if he knew what else he could do with $70,000. He said nope. So I got on my soapbox.

Those that know me well know that I am a huge Dave Ramsey fan; I listen to podcasts of his radio show on my commute, and my husband and are attempting to follow the general Financial Peace principles for our finances. I love sharing with other people how easy and freeing budgeting can be. I think I first got interested in family finances when I was in my senior year economics class in high school. My teacher showed us the classic bar graph to explain the importance of compound interest when saving for retirement, similar to this one from financiallife.org:

To help my young man understand how stupid it was to yearn for a $70,000 truck, I pulled up Dave Ramsey's investment calculator and plugged in some numbers. Hypothetically, say my student paid $10,000 down and financed the rest of the car. Not factoring in interest (I tried to keep this simple), a $60,000 car loan paid off over seven years means monthly payments of a bit over $800 a month. I plugged this number into the investment calculator - if he put $800/month into a mutual fund at, say, 8% interest, with that $10,000 starting balance, in seven years he would have nearly $108,000 in funds, OR he could have a $70,000 truck that would probably be worth around $25,000. I hypothetically said that if he leaves that $70,000 alone for twenty years, it would be over $300,000, and in 45 years when he is 60 and might want to retire early, he'd have $2.2 million. I then asked him if he'd rather have a $70,000 truck or $2.2 million. He said he'd take the millions. I left them playing with the calculator, seeing how much of their summer money they'd need to invest to be millionaires.

Now obviously they need a LOT more knowledge before they can reach that point, but to have a kid who is wildly unsuccessful in school see how a decision could affect him in the long-term is a big victory. So many of my students live exclusively in the here-and-now; they're not thinking about saving or college or even how a failed quiz could affect them in the long-term.

I brought up the calculator in a later class; one of the students said, "Oh, I know how you can make a million dollars - just buy $20,000 worth of lottery tickets!" I then quoted Dave Ramsey's "tax on the poor and bad at math" spiel and showed him how that $20,000 investment could make millions - and it's a sure thing (at least, WAY more sure than the chance of winning the lottery). I have no idea what sticks and what doesn't, but I love these conversations I get to have with my students; I often feel like no one else is having them with them.

Comments

Post a Comment